WHAT IS CAPITAL BUDGETING?

Capital budgeting is a company’s formal process used for evaluating potential expenditures or investments that are significant in amount. It involves the decision to invest the current funds for addition, disposition, modification or replacement of fixed assets. The large expenditures include the purchase of fixed assets like land and building, new equipments, rebuilding or replacing existing equipments, research and development, etc. The large amounts spent for these types of projects are known as capital expenditures. Capital Budgeting is a tool for maximizing a company’s future profits since most companies are able to manage only a limited number of large projects at any one time.

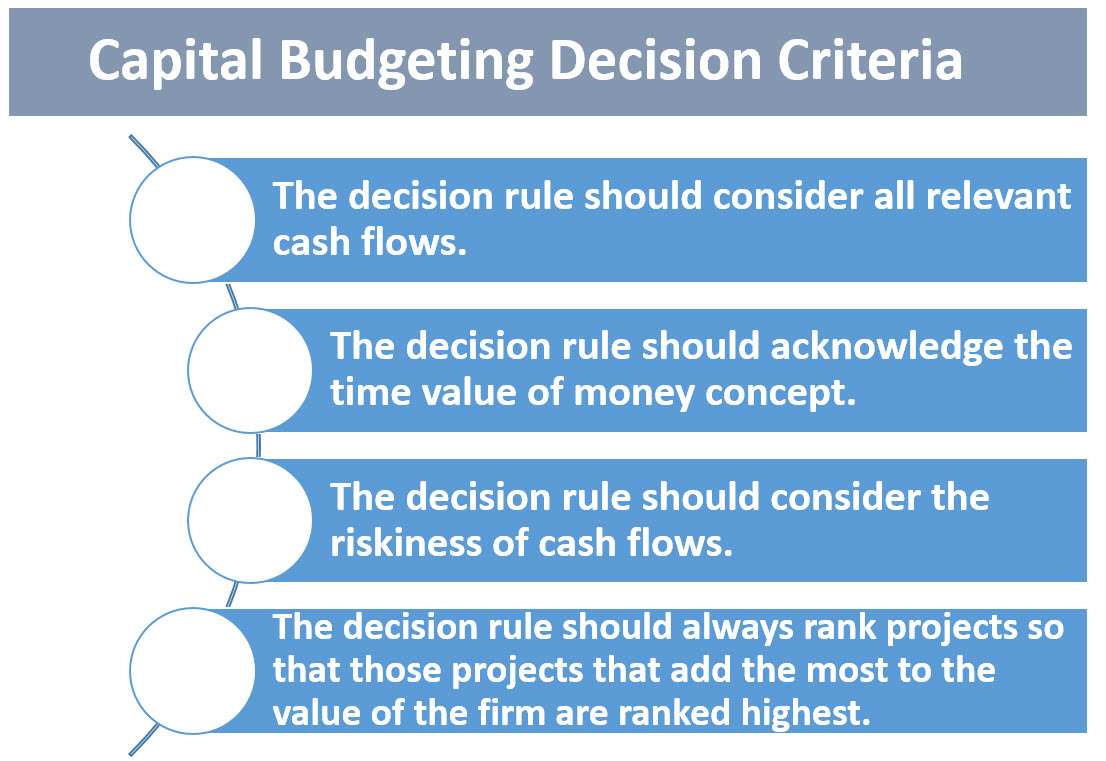

Capital budgeting usually involves calculation of each project’s future accounting profit by period, the cash flow by period, the present value of cash flows after considering time value of money, the number of years it takes for a project’s cash flow to pay back the initial cash investment, an assessment of risk, and various other factors.

Capital is the total investment of the company and budgeting is the art of building budgets.

FEATURES OF CAPITAL BUDGETING

1) It involves high risk

2) Large profits are estimated

3) Long time period between the initial investments and estimated returns

CAPITAL BUDGETING PROCESS:

A) Project identification and generation:

The first step towards capital budgeting is to generate a proposal for investments. There could be various reasons for taking up investments in a business. It could be addition of a new product line or expanding the existing one. It could be a proposal to either increase the production or reduce the costs of outputs.

B) Project Screening and Evaluation:

This step mainly involves selecting all correct criteria’s to judge the desirability of a proposal. This has to match the objective of the firm to maximize its market value. The tool of time value of money comes handy in this step.

Also the estimation of the benefits and the costs needs to be done. The total cash inflow and outflow along with the uncertainties and risks associated with the proposal has to be analyzed thoroughly and appropriate provisioning has to be done for the same.

C) Project Selection:

There is no such defined method for the selection of a proposal for investments as different businesses have different requirements. That is why, the approval of an investment proposal is done based on the selection criteria and screening process which is defined for every firm keeping in mind the objectives of the investment being undertaken.

Once the proposal has been finalized, the different alternatives for raising or acquiring funds have to be explored by the finance team. This is called preparing the capital budget. The average cost of funds has to be reduced. A detailed procedure for periodical reports and tracking the project for the lifetime needs to be streamlined in the initial phase itself. The final approvals are based on profitability, Economic constituents, viability and market conditions.

D) Implementation:

Money is spent and thus proposal is implemented. The different responsibilities like implementing the proposals, completion of the project within the requisite time period and reduction of cost are allotted. The management then takes up the task of monitoring and containing the implementation of the proposals.

E) Performance review:

The final stage of capital budgeting involves comparison of actual results with the standard ones. The unfavorable results are identified and removing the various difficulties of the projects helps for future selection and execution of the proposals.

FACTORS AFFECTING CAPITAL BUDGETING:

| Availability of Funds | Working Capital |

|---|---|

| Structure of Capital | Capital Return |

| Management decisions | Need of the project |

| Accounting methods | Government policy |

| Taxation policy | Earnings |

| Lending terms of financial institutions | Economic value of the project |

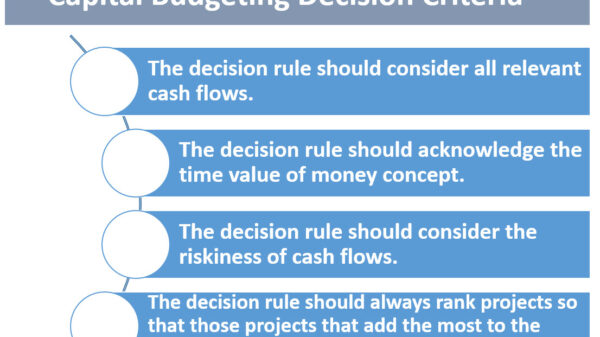

CAPITAL BUDGETING DECISIONS:

The crux of capital budgeting is profit maximization. There are two ways to it; either increase the revenues or reduce the costs. The increase in revenues can be achieved by expansion of operations by adding a new product line. Reducing costs means representing obsolete return on assets.

Accept / Reject decision – If a proposal is accepted, the firm invests in it and if rejected the firm does not invest. Generally, proposals that yield a rate of return greater than a certain required rate of return or cost of capital are accepted and the others are rejected. All independent projects are accepted. Independent projects are projects that do not compete with one another in such a way that acceptance gives a fair possibility of acceptance of another.

Mutually exclusive project decision – Mutually exclusive projects compete with other projects in such a way that the acceptance of one will exclude the acceptance of the other projects. Only one may be chosen. Mutually exclusive investment decisions gain importance when more than one proposal is acceptable under the accept / reject decision. The acceptance of the best alternative eliminates the other alternatives.

Capital rationing decision – In a situation where the firm has unlimited funds, capital budgeting becomes a very simple process. In that, independent investment proposals yielding a return greater than some predetermined level are accepted. But actual business has a different picture. They have fixed capital budget with large number of investment proposals competing for it. Capital rationing refers to the situation where the firm has more acceptable investments requiring a greater amount of finance than that is available with the firm. Ranking of the investment project is employed on the basis of some predetermined criterion such as the rate of return. The project with highest return is ranked first and the acceptable projects are ranked thereafter.

Source: edupristine.com

You must be logged in to post a comment Login